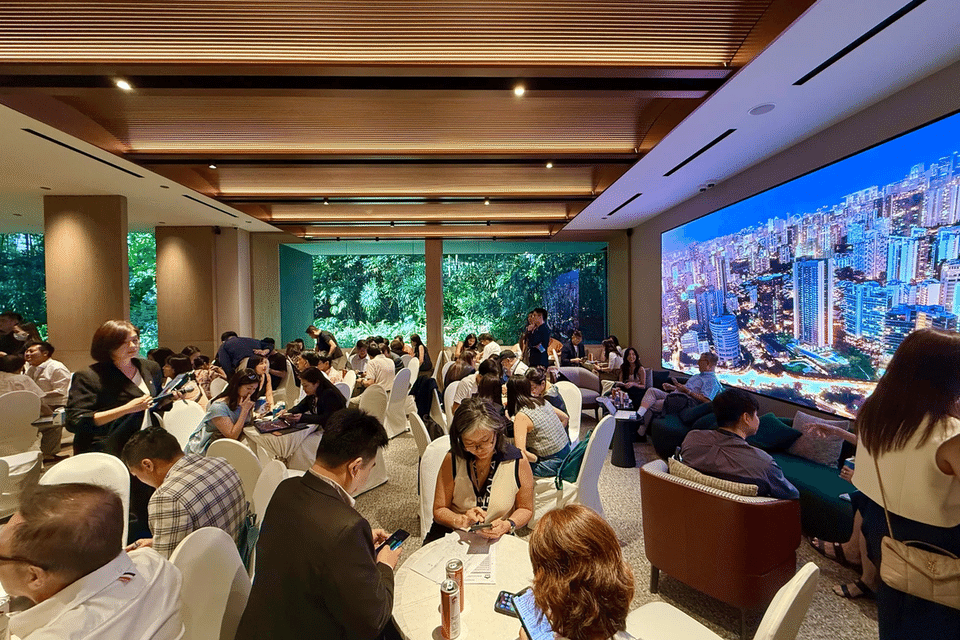

SINGAPORE – Two new projects in the core central region (CCR) – UpperHouse at Orchard Boulevard and The Robertson Opus – launched over the weekend, drawing firm demand, with both moving more than 40 per cent of their units.

The launches of UpperHouse (301 units) and The Robertson Opus (348 units) mark the largest supply injection in the CCR since additional buyer’s stamp duty measures were tightened in 2023, said PropNex chief executive Kelvin Fong.

UpperHouse, by UOL Group and Singapore Land Group (SingLand), sold 162 units or more than 53.8 per cent on July 19, at an average price of $3,350 per sq ft (psf).

The 99-year leasehold project offers units from one-bedroom and study to four-bedroom suites. Mr Fong added that one-bedders were priced at nearly $1.4 million, while two-bedders ranged from about $2.1 million to $2.7 million.

Mr Anson Lim, UOL’s senior general manager of residential marketing, noted “healthy take-up across all unit types”. The Bespoke Collection – 31 four-bedders with private lift and parking – had a 30 per cent take-up, with a high-floor unit selling for $7.66 million, or $3,724 psf.

UpperHouse is the best-selling CCR project since The M launched in 2020, said Huttons Asia chief executive Mark Yip. Nearly all three-bedroom units were sold, and one-third of the four-bedders were taken up, indicating “strong owner-occupier demand”.

Singaporeans and permanent residents made up 99 per cent of buyers, with the rest being foreigners. The project drew both owner-occupiers and long-term investors.

“To sell above 50 per cent of the units for a CCR project is an excellent set of results. It highlights the resilient demand for prime CCR homes and strong fundamentals in Singapore’s property market,” Mr Yip noted.

UOL’s chief corporate and development officer Yvonne Tan attributed the strong showing to the narrowing price gap between CCR and the rest of central region (RCR), and the attractive premium between freehold and leasehold luxury products. Huttons data shows that the median psf price gap between CCR and RCR narrowed from 56.5 per cent in 2018 to 1.9 per cent in the first half of 2025. “There is potential for a strong upside once the gap between CCR and RCR home prices widens,” said Mr Yip.

Mr Fong also noted that the average price of $3,350 psf makes UpperHouse one of the most competitively priced new launches near Orchard Road.

He compared this with Park Nova’s new units, which averaged at about $6,150 psf in 2025, and Cuscaden Reserve, which fetched an average price of more than $3,100 psf for the resale units transacted in the first four months of 2025.

Located in District 10, UpperHouse is situated at Grange Road and Orchard Boulevard, opposite Orchard Boulevard MRT and near River Valley Primary School.

UOL and SingLand acquired the 7,013.4 sq m site in 2024 for $428.3 million or $1,617 psf per plot ratio (ppr) – 30 per cent to 40 per cent lower than the $2,377 psf ppr fetched by a nearby Cuscaden Road site in 2018.

Steady take-up at The Robertson Opus

Over at the mixed-use The Robertson Opus, of the 348 units available, 143 were sold at an average price of $3,360 psf. This works out to a take-up rate of 41 per cent, said developers Frasers Property and Sekisui House on July 20.

The 999-year development comprises one- to four-bedroom units across five blocks. Studio units start from $1.37 million, one-bedders from $1.58 million, two-bedders from $2.17 million, three-bedders from $3.1 million, and four-bedders (1,539 sq ft) from $5.09 million.

“There has been healthy demand across all the unit types, with the three-bedroom and four-bedroom premium units under the Legacy Collection being the most popular and almost sold out,” said the developers.

The buyers comprise professionals purchasing for their own stay or investment – 83 per cent are Singaporeans, 16 per cent are permanent residents mainly from China and Indonesia, and the rest are foreigners from the US and Switzerland.

The Robertson Opus, which has a retail podium on the first floor and basement, is a redevelopment of Frasers’ serviced residence Fraser Place Robertson Walk and its adjoining commercial area, Robertson Walk – undertaken by Frasers Property and Japanese developer Sekisui House in a 51:49 joint venture.

Given the steady take-up at both launches, PropNex’s Mr Fong expects third-quarter developers’ sales in the CCR to rebound.

“To be sure, the units sold at UpperHouse at Orchard Boulevard during the private preview alone has already far exceeded the 46 CCR new units sold for the whole of Q2 2025.”

Despite the recent hike in seller’s stamp duty rates, demand for luxury homes remains resilient, supported by buyers focused on capital stability and wealth diversification, said Mr Mohan Sandrasegeran, head of research and data analytics at Singapore Realtors.

“These factors point to a strategic reset in the CCR market. With strong fundamentals, supportive policies, and improving economic signals, the luxury housing segment is well-positioned to regain momentum.”

Brisk sales at Otto Place EC

The 600-unit Otto Place at Plantation Close in Tengah is located near two MRT stations and Princess Elizabeth Primary School.

Also over the weekend, executive condominium (EC) Otto Place sold 351, or 58.5 per cent, of its 600 units at its launch, said developers Hoi Hup Realty and Sunway Developments. The average price of its units sold under the normal payment scheme was $1,700 psf.

Otto Place features unit sizes from 872 sq ft for three-bedroom deluxe types, priced from $1.41 million ($1,617 psf), up to 1,195 sq ft for four-bedroom plus study luxury units, which went for $2.18 million ($1,824 psf). More than 70 per cent of the larger units were sold.

Located in Tengah’s Plantation District, Otto Place is near two MRT stations and Princess Elizabeth Primary School.

ERA Singapore chief executive Marcus Chu said: “Despite broader economic headwinds, demand for ECs remains strong, supported by steady local interest, significant price advantages over private condos and government grants.”